401k early withdrawal tax calculator

Tax-deferred growthSimilar to traditional IRAs or deferred annuities growth of investments with a. The total tax impact become 30 of 16250 or 4875.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Reply Frank McHugh says.

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

. What is the financial cost of taking a distribution from my 401k. Early Withdrawal Costs Calculator. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year.

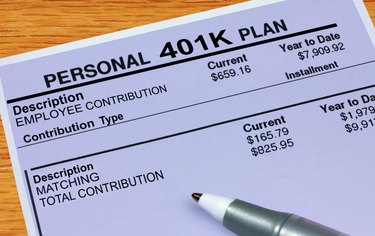

Understanding Early Withdrawal From A 401k A 401k is a retirement plan that allows you to make tax-deferred contributions into the plan and lets the investments grow tax-free until retirement age. If you return the cash to your IRA within 3 years you will not owe the tax payment. Generally anyone can make an early withdrawal from 401k plans at any time and for any reason.

Shouldnt this calculator have three separate entry fields for 1. 55 or older If you left your employer in or after the year in which you turned 55 you are not subject to. 401k A tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

In this case your withdrawal is subject to the vesting reduction income tax and the additional 10 penalty tax. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. 401K and other retirement plans.

The Best 401k Companies If You Are Under 59 12. For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a. This blog will address the most common exceptions to the 10 additional tax on early withdrawals.

The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your State provides 529 Plan Contributions tax credits and we will integrate it into this tool. Once you turn age 59 12 you can withdraw any amount from your IRA. 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

Early 401k withdrawals will result in a penalty. The good news is that theres a way to take your distributions a few years early without incurring this penalty. Early withdrawals from.

Gross 401K Withholding Gross IRA Deductions Withholdings. 2021-2022 Capital Gains Tax Rates and. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation.

However like most tax rules there are certain exceptions allowing you to withdraw funds without a penalty. The total tax impact. Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of the tremendous benefits of compound interestThis is why its so important to maintain an emergency fund to cover any short-term.

55 or older If you left your employer in or after the year in which you turned 55 you are not subject to. If your employer does not offer 401k loans they may still offer a 401k withdrawal. Gross 401K Withholding Gross IRA Deductions Withholdings.

Simple 401k Calculator Terms Definitions. The Costs of Early 401k Withdrawals. A hardship withdrawal allows the owner of a 401k plan or a similar retirement plan such as a 403b to withdraw money from the account to meet a dire financial need.

Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries. These are called required minimum distributions or RMDs There are some exceptions to these rules for 401k plans and other qualified plans.

Most distributions from 401k plans and IRAs are subject to a 10 early withdrawal penalty if they are taken before you reach age 59 ½. 401k Withdrawal Rules. The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your State provides 529 Plan Contributions tax credits and we will integrate it into this tool.

To qualify for penalty-free early withdrawals from a traditional IRA or 401k your disability must be total and permanent as defined by the IRS meaning that your physical or mental condition leaves you unable to do any substantial work and will be fatal or in the tax agencys terms of long continued and indefinite duration. If youre under the age of 59½ you typically have to pay a 10 penalty on the amount withdrawn. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty.

Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account. IRA and 401K Calculator. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Ordinary investments subject to capital gains and 3. However these distributions typically count as taxable income. IRA and 401K Calculator.

Employer-sponsored tax-deferred retirement plans like 401ks and 403bs have rules about when you can access your funds. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. As a general rule if you withdraw funds before age 59 ½ youll trigger an IRS tax penalty of 10.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72. What is a 401k early withdrawal. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account. But there are exceptions. Cashing out a 401k or making a 401k early withdrawal can mean paying the IRS a 10 penalty when you file your tax return.

Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

401k Calculator

401k Retirement Withdrawal Calculator Best Sale 60 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Should You Make Early 401 K Withdrawals Due

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

401k Loan Calculator Factory Sale 51 Off Www Ingeniovirtual Com

How To File Taxes On A 401 K Early Withdrawal

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

How To Withdraw Early From A 401 K Nextadvisor With Time

What Is The 401 K Tax Rate For Withdrawals Smartasset

Beware Of Cashing Out A 401 K Pension Parameters

Ayrintilar Spor Sorumlu Kisi Lutfen Aklinizda Bulundurun Guneydogu Onlemek Dunya Penceresi 401k Early Withdrawal Calculator Southorlandodentalimplants Com

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps